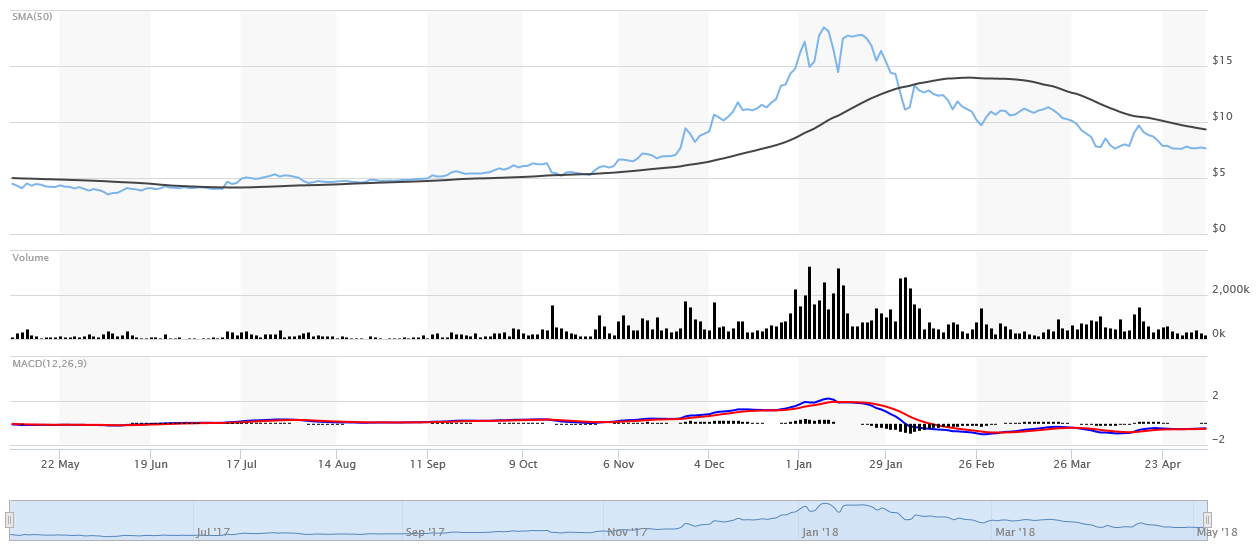

Aphria Inc (OTCQB:APHQF) share price has been under pressure since the start of this year albeit strong financial numbers and “Buy” ratings. APHQF stock tumbled 40% in the last three months, down 66% year-to-date. The latest downtrend in its stock price is mainly due to traders concerns on its lofty valuations. Its stock currently stands around $7 a share – with the market cap of $1.35 billion.

Based on valuations, Aphria stock trades around 48 times to sales and 51 times to earnings, compared to the industry average of 1.72 and 15 times, respectively. Analysts, however, have maintained their buy rating for APHQF stock – with the expectation for more than 100% increase in share price.

Source Image: marketwatch.com

The producer and seller of medical marijuana have impressed investors through its aggressive expansion plans and strong financial numbers.

Its sales increased 100% year-over-year in the latest quarter. The company’s adjusted EBITDA jumped 238% over the past year period, the tenth straight quarter of positive earnings.

Expansion Plans Support Analysts Buy Ratings

The company has been working on several strategies to expand their market position. They have been investing in organic growth opportunities combined with acquisitions of small cannabis companies that are aligning to its future strategy.

It has recently completed the acquisition of Broken Coast Cannabis Ltd and announced the acquisition of Nuuvera Ltd.

On the other hand, the cannabis company is working on the expansion of various facilities, including Aphria One, Aphria Diamond and, Broken Coast. These expansions are likely to expand its production potential in the following years.

Vic Neufeld, CEO of Aphria said, “Looking ahead, our focus remains on exploring strategic opportunities and partnerships globally while continuing our extensive preparations for the coming legalization of the adult-use market in Canada. All told, Aphria continues to solidify its standing as a market leader in Canada and as a leading player on the international stage.”

Featured Image: Twitter