CALGARY, AB, Nov. 28, 2024 /CNW/ – CanadaBis Capital (CANB.V) a leader in the Canadian cannabis industry, is proud to announce its financial results for the year ending July 31, 2024. The company is pleased to report a positive net income of $600,285, marking a significant achievement as CanadaBis continues to grow and solidify its position in the market.

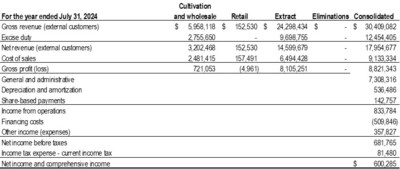

Key Financial Highlights for the Fiscal Year Ended July 31, 2024:

- Net Income: CanadaBis Capital achieved a positive net income of $600,285, reflecting the company’s strong performance despite higher costs associated with new product launches and operational expansions.

- Record Sales: The Company sold a of over 1,800,000 units of combined concentrate and dry flower for the year ended July 31, 2024, a 6% increase compared to the 1,700,000 units sold over the comparative period.

- Revenue Growth: The company experienced solid revenue growth, driven by the successful introduction of new high-potency THC products under the Dab Bods brand and the continued popularity of its core product offerings.

- Cost of Goods Sold (COGS): While COGS increased due to higher production volumes and expanded product lines, CanadaBis was able to manage these costs effectively through strategic purchasing initiatives and operational efficiencies.

Strategic Growth and Operational Efficiencies

CanadaBis Capital has continued to focus on both product innovation and operational excellence. The successful expansion of the Dab Bods brand, with the launch of high-potency THC products from April 2023 to July 2024, has contributed significantly to the company’s revenue growth. These new products, which include premium concentrates and extracts, have received a strong response from the market and are expected to drive continued growth in the coming fiscal year.

In addition, the company’s existing product portfolio, which includes Super Slim Cigarette Style Pre-Rolls, Milled Flower, Distillate Infused Pre-Rolls, RSO Gel Capsules, Moon Rocks, and the award-winning Phoenix Tears, continues to perform well and support overall growth.

One of the key factors driving CanadaBis’s profitability in fiscal 2024 was the implementation of operational efficiencies. The company’s ability to strategically purchase input materials in high volumes allowed it to reduce production costs, improving margins despite the challenges posed by inflationary pressures and rising input costs.

A Strong Outlook for 2025 and Beyond

CanadaBis Capital’s positive net income and strong financial results reflect the company’s ongoing focus on product innovation, market expansion, and cost management. With the success of its existing product lines and the introduction of new, high-demand products under the Dab Bods brand, CanadaBis is well-positioned for continued growth in the coming years.

“As we close out fiscal 2024 with a positive net income, we are encouraged by the momentum we have built and the opportunities that lie ahead in the coming fiscal Quarters. The financial performance for fiscal 2024 reflects both the growth we’ve experienced and our ongoing efforts to control costs through strategic purchasing and operational efficiencies. We are pleased that product diversification has proven effective, and we are confident that these strategies will continue to drive long-term success for our company.” said Travis McIntyre, CEO of CanadaBis Capital.

Annual Meeting

At the Annual & Special Meeting (the “Meeting”) held on November 21, 2024, all resolutions proposed to shareholders were duly passed.

Shareholders approved the election of all individuals to the Board of Directors of the Company, being Travis McIntyre, Nicole Bacsalmasi, Alex Michaud, Barbara O’Neill and Shane Chana. In addition, shareholders also approved fixing the number of directors at five, the appointment of BDO Canada LLP as Auditors, the ratification of the stock option plan and a resolution giving management the discretion to change the Company’s name at some point in the future should such a change offer strategic benefit for CanadaBis.

“I am very pleased to be joined by such a skilled and dedicated group of individuals on our Board of Directors as we move into the next stages of our corporate evolution, which may include a name change in the future should management determine a rebrand offers incremental strategic benefit,” said Travis McIntyre, President and Director of CanadaBis. “We are grateful to have our Board’s wealth of experience, which will continue to be invaluable as we navigate our growth trajectory.”

ABOUT CANADABIS CAPITAL INC.

CanadaBis Capital Inc. (TSXV:CANB) is a vertically integrated Canadian cannabis company focused on achieving large-scale growth, from cultivation to retail, in the fast-emerging global cannabis market. By targeting organic growth opportunities alongside the right-fit partners, we remain focused on finding and capitalizing on chances to grow, diversify and continue to lead our industry.

Our integrated subsidiaries:

- Stigma Pharmaceuticals Inc. – 100% held

- 1998643 Alberta Ltd. (operating as “Stigma Grow“) – 100% held; www.stigmagrow.ca

- Full Spectrum Labs Ltd. (operating as “Stigma Roots“) – 100% held

- 2103157 Alberta Ltd. (operating as “INDICAtive Collection“) -100% held; www.indicativecollection.ca

- Goldstream Cannabis Inc. – 95% held

ABOUT STIGMA GROW

Stigma Grow is a cutting-edge cannabis cultivation and extraction company positioned advantageously to meet the unmet market demands and stigmas within the legal cannabis industry head on, with products designed to disturb the status quo and dramatically shift the conversation surrounding Canada’s legal cannabis industry.

CAUTIONARY STATEMENTS Non-GAAP Measures

This news release contains the financial performance metric of Adjusted EBITDA, a measure that is not recognized or defined under IFRS (a “Non-GAAP Measure”). As a result, this data may not be comparable to data presented by other cannabis companies. For an explanation and reconciliation of Adjusted EBITDA to related comparable financial information presented in the Financial Statements prepared in accordance with IFRS, refer to the MD&A for the three months ended October 31, 2023. The Company believes that Adjusted EBITDA is a useful indicator of operational performance and is specifically used by management to assess the financial and operational performance of the Company.

Adjusted EBITDA is a measure of the Company’s financial performance. It is intended to provide a proxy for the Company’s operating cash flow and is widely used by industry analysts to compare CanadaBis to its competitors and derive expectations of future financial performance of the Company. Adjusted EBITDA increases comparability between comparative companies by eliminating variability resulting from differences in capital structures, management decisions related to resource allocation, and the impact of fair value adjustments on biological assets, inventory, and financial instruments, which may be volatile on a period-to-period basis. Adjusted EBTIDA is not a recognized, defined, or standardized measure under IFRS. The Company calculates Adjusted EBITDA as net income (loss) and comprehensive income (loss) excluding changes in fair value of biological assets, change in fair value of biological assets realized through inventory sold, depreciation and amortization expense, share-based payments, and finance costs.

Regarding Forward-Looking Information

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include but are not limited to statements with respect to our business and operations; timing of the Sundial products coming to market; the demand and market for live-resin vape cartridges, and our general business plans. Forward-looking statements are necessarily based upon a number of assumptions including: the ability of the Company’s products to compete with the pricing and product availability on the black-market; the market demand for the Company’s products; and assumptions concerning the Company’s competitive advantages. These assumptions, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward- looking statements. Such factors include, but are not limited to: compliance with extensive government regulation, the general business, economic, competitive, political and social uncertainties; ability to sustain or create a demand for a product; requirement for further capital; delay or failure to receive board, shareholder or regulatory approvals; the results of operations and such other matters as set out in the Company’s continuous disclosure on SEDAR at www.sedar.com. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking statements. Investors are cautioned that forward-looking information is not based on historical facts but instead reflects management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although we believe that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have a material adverse effect on our future results, performance or achievements.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE CanadaBis Capital Inc.

Featured Image: Megapixl @ Nevodka