The recent divergence in opinions between corporate executives and financial analysts regarding the future trajectory of the S&P 500 index has sparked considerable interest among investors. While CEOs appear to exhibit a more cautious outlook, analysts maintain a relatively optimistic stance. This disparity raises intriguing questions about the factors influencing these perspectives and their potential implications for market participants.

CEOs, who are directly involved in the day-to-day operations of their companies, have expressed concerns about various macroeconomic challenges. These include ongoing supply chain disruptions, rising inflation, and geopolitical tensions, which collectively pose risks to corporate profitability and economic growth. Consequently, many CEOs are adopting a conservative approach, prioritizing cost control and operational efficiency to navigate this uncertain environment.

In contrast, financial analysts, who typically rely on a combination of quantitative models and market trends, have generally maintained a more positive outlook. Their optimism is often driven by expectations of sustained economic recovery, robust corporate earnings, and continued monetary support from central banks. Analysts emphasize that despite short-term headwinds, the long-term fundamentals supporting equity markets remain intact.

One notable example of this divergence is evident in the case of Chipotle (NYSE:CMG). The company has been grappling with supply chain challenges and rising input costs, prompting its executives to adopt a cautious stance. However, analysts covering Chipotle remain optimistic about the company’s growth prospects, citing its strong brand, innovative menu offerings, and strategic expansion plans.

Another factor contributing to the differing perspectives is the focus on different time horizons. CEOs often prioritize stability and risk management, as their decisions directly impact company performance in the short to medium term. Analysts, on the other hand, tend to focus on longer-term trends and potential upside opportunities, which can lead to more bullish forecasts.

Investors navigating these differing viewpoints should consider a balanced approach. While it is essential to heed the warnings and insights provided by CEOs regarding operational challenges, it is equally important to recognize the potential for economic recovery and market growth highlighted by analysts. Diversification and a focus on quality assets can help investors manage risks while capitalizing on long-term opportunities.

The ongoing debate between CEOs and analysts underscores the complexity of predicting market movements, particularly in a rapidly evolving economic landscape. As the global economy continues to adapt to new challenges, investors must remain vigilant and informed to make well-rounded investment decisions.

Footnotes:

- The divergence in opinions between CEOs and analysts highlights the complexity of market predictions. Source.

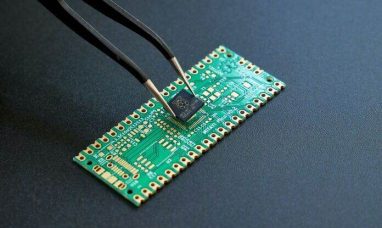

Featured Image: Megapixl @ Rawpixelimages