Are these Top Artificial Intelligence Stocks On Your Watchlist This Month?

For investors looking to invest in booming fields in the tech trade,

artificial intelligence (AI) stocks

are a viable play. Namely, the stock market today is home to various AI firms that employ the tech in a vast array of industries. This would be the case as the use cases for the tech continues to grow day by day. After all, not only does AI help organizations with computational issues, but the tech is constantly improving via machine learning. As a result, investors would be keeping an eye on emerging names in the field. This is evident given the latest news regarding the Bill and Melinda Gates Foundation (the Foundation).

Namely, the Foundation is now in a four-year deal with U.K.-based AI start-up, Exscientia. Through the potentially $70 million deal, Exscientia aims to develop “novel antiviral pills that could be used to treat COVID-19 and stop future pandemics from spreading”. Accordingly, it would not surprise me to see the top artificial intelligence stocks gaining traction in the

stock market

now. If anything, major names in the industry continue to make plays as well.

As of last week,

Alphabet

(

NASDAQ: GOOGL

) and

C3.Ai

(

NYSE: AI

) are currently working together. In detail, the partnership marks an industry-first as the duo look to accelerate enterprise AI. According to C3.Ai, they will provide industry solutions, addressing “real-world challenges” in the financial services, healthcare, manufacturing, and telecommunications industries. By and large, the market for AI and AI-focused companies continues to grow. With that being said, here are three top artificial intelligence stocks for your September 2021 watchlist.

Best Artificial Intelligence Stocks To Watch Right Now

-

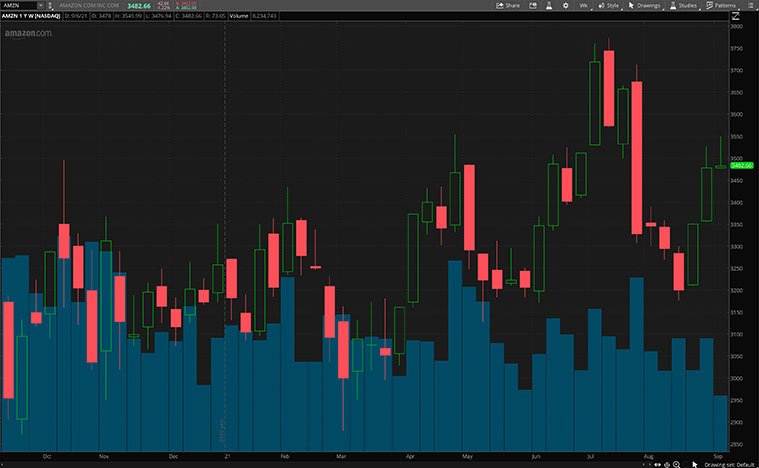

Amazon.com Inc.

(

NASDAQ: AMZN

) -

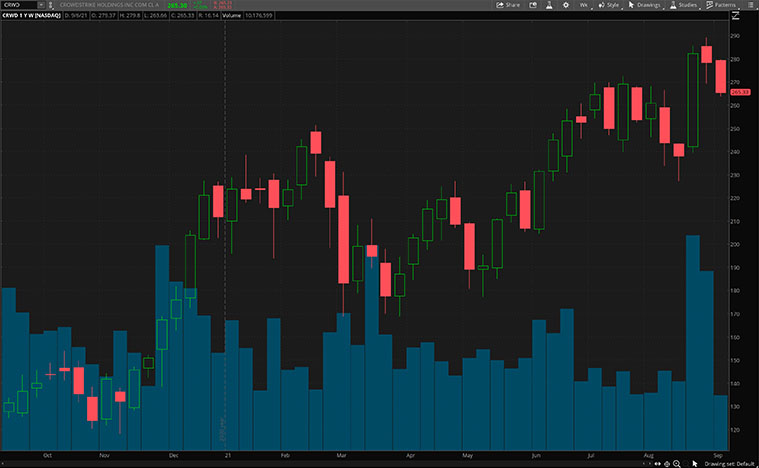

CrowdStrike Holdings Inc.

(

NASDAQ: CRWD

) -

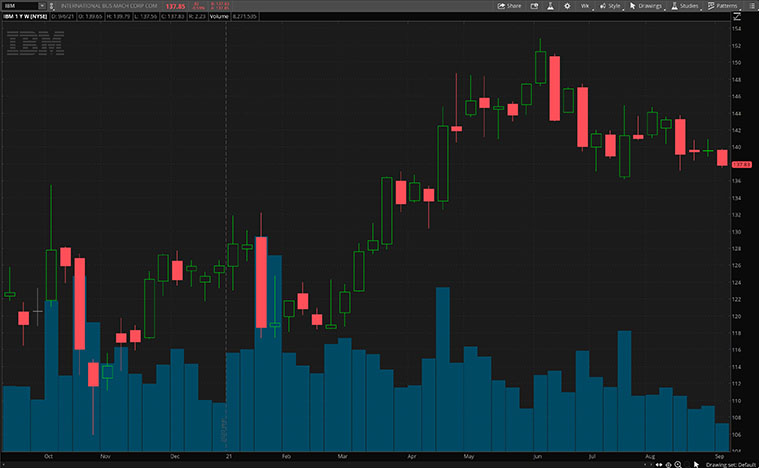

IBM Corporation

(

NYSE: IBM

)

Amazon.com Inc.

Amazon

is a multinational tech company that focuses on e-commerce and artificial intelligence. Namely, through its Amazon Web Services (AWS), the company offers the broadest and deepest set of machine learning services and supporting cloud infrastructure. With that, it essentially puts machine learning in the hands of every developer, data scientist, and expert practitioner. Amazon has collaborated with companies like

T-Mobile

(

NASDAQ: TMUS

), which has used AWS to reshape how customers relate to them. AMZN stock currently trades at $3,484.98 as of 3:51 p.m. ET.

Today, the company announced an all-new line-up of Fire TV devices with its first-ever Amazon-built smart TVs. The Fire TV Omni Series integrates the Fire TV experience and far-field voice technology directly into the TV, providing an all-in-one entertainment device for streaming, cable TV, music, gaming, and more. Hands-free Alexa voice controls are always available whether the TV is on or off or when using an HDMI input. This would take integration to the next level when coupled with Amazon’s Prime subscription.

In late July, the company reported its second-quarter financials. Notably, net income for the quarter increased to $7.8 billion or $15.12 per diluted share. Net sales increased by 27% year-over-year to $113.1 billion in the second quarter and operating income increased to $7.7 billion compared with $5.8 billion a year earlier. Also, the company announced a six-year collaboration with

Ford

(

NYSE: F

) to bring Alexa to millions of retail and commercial vehicles in North America. The deal is the industry’s broadest roll-out of the Built-in Alexa hands-free experience. All things considered, will you watch AMZN stock?

Read More

CrowdStrike Holdings Inc.

Next up, we have

CrowdStrike,

a cybersecurity company that utilizes its Falcon platform to detect threats and stop breaches. In essence, its Falcon platform is the first multi-tenant, cloud-native, intelligent security solution that is capable of protecting workloads across a variety of endpoints. Boasting over 19 cloud modules on its platform via a Software-as-a-Service model that spans multiple large security markets. CRWD stock currently trades at $265.45 as of 3:52 p.m. ET and has more than doubled in valuation in the past year alone.

On August 31, 2021, the company reported its second-quarter financials. Diving in, it reported total revenue of $337.7 million, a 70% increase compared to a year ago. Unsurprisingly, subscription revenue made up a huge chunk of this revenue at $315.8 million. Also, its Annual Recurring Revenue increased by 70% year-over-year and grew to $1.34 billion. The company also ended the quarter with $1.79 billion in cash and cash equivalents.

Not to mention, CrowdStrike continues to make massive strides on the operational front. As of yesterday, the company is now working with Medigate, an Internet-of-Things security provider for the health care industry. Through the current partnership, CrowdStrike is providing its cloud-delivered endpoints and workload protection to health care delivery organizations. To highlight, this marks the industry’s first instance of a “

consolidated view of threat activity and incident response

” according to Medigate. For these reasons, will you consider adding CRWD stock to your portfolio right now?

[Read More]

3 Top Solar Energy Stocks To Watch As President Biden Expands U.S. Solar Energy Plans

IBM Corporation

Last but not least, we will be taking a look at the

IBM Corporation

. For the most part, the company is a leading name across the board in the world of tech. Whether it is existing tech or ground-breaking fields such as AI and quantum computing, IBM is innovating in the space. For a sense of scale, the company operates in over 171 countries across the globe. Given the reach and depth of IBM’s tech portfolio, it would make sense that investors are eyeing IBM stock now. As it stands, the company’s shares currently trade at $138.01 as of 3:54 p.m. ET.

Now, despite its vast operations, IBM continues to find more room to grow. Firstly, the company is currently working with IntelePeer, a leading Communications Platform-as-a-Service (CPaaS) provider. Through the current partnership, IntelePeer’s Atmosphere CPaaS offering is now available on IBM’s Watson Assistant. In practice, it will help businesses bolster their AI-powered virtual assistants with voice capabilities, without the need for third-party integrations. Daniel Hernandez, General Manager of Data and AI at IBM said, “

IBM is bringing the latest innovations in natural language processing, automation and advancing responsible AI to Watson Assistant so that businesses can transform the customer experience and boost operational efficiency

.”

On top of that, IBM is also hard at work expanding its cloud-related offerings as well. Earlier this week, the company collaborated with

Sumo Logic

(

NASDAQ: SUMO

), a pioneering name in continuous intelligence tech. The duo announced the launch of Sumo Logic’s Continuous Intelligence Platform on the Red Hat Marketplace, an open cloud marketplace for enterprise customers. With all this in mind, would IBM stock be a top watch for you?