Tech earnings are set to take off in one of the most eventful weeks this quarter in terms of the Fed meeting and scheduled data releases. So we’ll soon have the Conference Board’s Consumer Confidence Index for January, as well as the Commerce Department’s fourth-quarter GDP report and the December personal income and spending report. And in the midst of all this, Omicron keeps raging on at home while Russia and Ukraine look set for a confrontation internationally.

It’s an understatement to say that the markets are selling off, a market rout seems to be a more appropriate description. And it’s hardly the best environment to be buying. But as Warren Buffett is oft-quoted: be fearful when others are greedy and greedy when others are fearful.

So it’s alright to take risk as long as you take it nice and easy. All the negative news flow and the market sell off could be setting you up for opportunities you won’t get in a long time. So I’ve picked 3 great growth stocks here that are getting thrashed right now but with strong potential for a bounce-back on the strength of their respective businesses.

Take a look-

Tesla Inc.

TSLA

Tesla shares carry a Zacks Rank #1 (Strong Buy) and ESP of 4.69%. So our proprietary technique is pointing to a positive surprise when the company reports on Jan 26.

As far as price reaction to Tesla’s results is concerned, it’s worth noting that the company hasn’t topped estimates in all of the last few quarters. Nor have investors reacted positively all of the time. But this trend appears to have been changing over the last couple of quarters and it now appears that investors will pay more for good results.

Tesla’s shares are trading relatively close to their median value over the last two years. This is not such a bad thing since those sales have really taken off since the pandemic hit in March of 2020. So there may not be that much more to fall. On the other hand, the current situation could help you buy some shares at valuations that may not be available once the current situation blows over.

STMicroelectronics N.V.

STM

STMicroelectronics has a Zacks Rank #1 and ESP of 3.57%. So there is a good chance the company will beat estimates when it reports on Jan 27.

Price reaction to STMicroelectronics’ earnings surprises has been erratic in the last few quarters and were likely driven by management commentary about future expectations. So this quarter is unlikely to be any different. But it appears that there is positive expectation about the quarter, which is also borne out by the revisions history for STMicroelectronics.

STMicroelectronics shares are trading well below their median level (based on price-to-forward 12 months’ earnings) over the last five years. They are also trading at a discount to the S&P 500. This could support prices despite the near-term concerns.

Microsoft Corporation

MSFT

Microsoft’s Zacks #2 Rank and ESP of 0.0% indicate a positive earnings surprise when it reports after the bell today.

Microsoft has a fairly consistent history of beating analyst estimates although this hasn’t hugely impressed investors since the pandemic hit. This may have been because expectations were running too high because of the company’s role in the digital economy. But things appear to be normalizing now given the relatively saner response to the last quarter’s results. And the analyst estimate revisions history for Microsoft remains positive.

Microsoft shares are trading close to their median value over the last five years. So although they may seem overvalued with respect to the S&P 500, there are other factors to do with the company’s earnings power, scale of operation and cash flow, in addition to its innovative prowess that tend to support these levels.

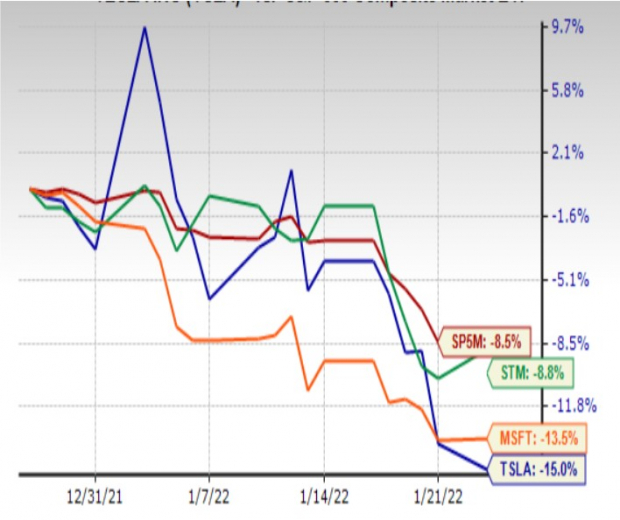

One-Month Price Performance

Image Source: Zacks Investment Research

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report