Technology stocks have suffered throughout 2022. At times, they felt unstoppable over the last few years, rolling over any doubters and paving the way for investors to reap a multitude of gains. Now that the music has seemingly been shut off, investors have been left wondering when the tide will shift back in their favor.

Supply chain and geopolitical issues have undoubtedly added fuel to the fire sale, but the spark was created earlier in the year whenever inflation had been reported to be at its highest levels in decades. Needing to act swiftly, the Fed opted to raise interest rates by levels not seen in years.

Since high-flying tech and growth stocks are among some of the heaviest borrowers, the market has been pricing in the fact that future cash flows of these companies have been drastically affected by higher interest rates.

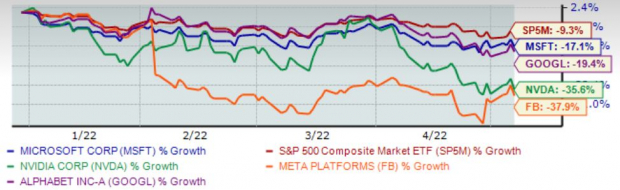

We can see just how far investors’ sentiment toward these companies has shifted in the chart below. It reflects the year-to-date performance of a few heavy hitters in the tech arena – Microsoft

MSFT

, Alphabet

GOOGL

, Nvidia

NVDA

, and Meta Platforms

FB

– while blending in the S&P 500 as well for a benchmark.

Image Source: Zacks Investment Research

While the unique economic environment we’re currently in has caused these stocks to tumble, the story is far from over for many of these companies. One company, in particular, Microsoft (MSFT), still has plenty of room to grow.

There are three reasons why investors shouldn’t close the curtain on MSFT just yet, and that’s what we’re here to discuss today.

Strong Footprint Within Gaming

During the earlier and mid-phases of the pandemic, the world was shut down. We had to work, study, and communicate within a digital landscape. After being confined to the house, video games quickly became a popular way to pass the time, spurring innovation and growth in the space, with companies soon taking notice.

Noticing the trend, Microsoft (MSFT) acquired Activision Blizzard

ATVI

for $68.7 billion back in January to bolster its stance within the gaming industry. Activision Blizzard is a leader in video game development and an interactive entertainment content publisher, most well-known for

Call of Duty

. It was a massive deal; it ranks as the largest acquisition in the gaming industry’s history.

MSFT already owns two massive video game titles,

Halo

– the company’s flagship video game, and

Minecraft

– the best-selling game of all time. The company has published all of ATVI’s video game titles onto its Xbox Game Pass, a unique gaming service that allows gamers unlimited access to a library of games for a flat rate of $9.99 per month.

Xbox Game Pass subscriber count exceeded 25 million players in January of this year, and ATVI titles currently have around 400 million monthly active players. Providing affordable access to the most iconic gaming franchises will undoubtedly fuel Microsoft’s gaming segment growth and propel its top line.

Microsoft Azure

Microsoft Azure is the company’s cloud computing service. It’s the only consistent hybrid cloud, delivering unparalleled developer productivity and comprehensive, multilayered security. Cloud computing is quickly becoming a competitive space, and MSFT has already established itself as a significant player in this arena.

Microsoft’s Azure cloud platform paved the way for a strong performance in its latest quarterly report. It reported better-than-expected commercial booking growth of 28%, and Azure Cloud revenue was $23.4 billion, up 32% year-over-year. Additionally, MSFT believes that cloud technology will be a critical growth driver of the world’s economic output and will further boost its top line in the future.

Azure faces stiff competition from Amazon’s

AMZN

AWS cloud platform, the largest in the world. However, Azure is now available globally in more than 60 regions, strengthening its foothold in the space.

Shareholder-Friendly Nature

Microsoft is a very shareholder-friendly company. Unlike a wide array of high-flying tech stocks, MSFT pays out dividends, and it also has a track record of share buybacks throughout the years.

Microsoft’s dividend yield sits at a respectable 0.86%, with a sustainable payout ratio of 27% of earnings. What sticks out to me is its five-year annualized dividend growth rate of 10.2%; MSFT has raised its dividend five times in the past five years.

Additionally, the company has share repurchase programs in place, another shareholder-friendly aspect of the company. When companies repurchase their stock, it increases the value of remaining shares as there is now less common stock outstanding, and the company’s earnings are split among the lower number of shares.

In September 2021, the company’s board approved a $60 billion stock repurchase program. These stock repurchases come every three years; MSFT approved buyback programs in 2013, 2016, 2019, and now FY22.

Bottom Line

It’s easy to become disheartened and lose trust in a company after witnessing its valuation get slashed by double-digit figures. However, this unique economic environment we’re in coming out of a once-in-a-lifetime pandemic has been the driving force behind the poor share performance. Additionally, with just how high valuation multiples climbed over the last two years, a pullback looks more than healthy.

MSFT is still a very sound investment, and I believe it will continue to be so moving forward in the future. A loaded gaming library in a booming videogame industry, robust Azure Cloud services, and shareholder-friendly moves such as an increasing dividend and stock repurchase programs are three reasons investors shouldn’t fear the pullback.

Earnings are expected to grow 18% in FY22, and for the next year, the Zacks Consensus Estimate has earnings growing by nearly 14%. MSFT is a Zacks Rank #3 with an overall VGM Score of a C.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report