It’s been a hard-fought war within the market throughout 2022, and tech stocks have seemingly been the biggest targets. Buyers have entirely retreated, and the bears continue to push forward. They’re fully rested from the hibernation they have been in over the last several years, and the immense amount of selling has displayed their strength.

Following a once-in-a-lifetime pandemic, the unique economic environment we’ve found ourselves in has caused the Fed to become much more hawkish. The Fed opted to raise interest rates to combat inflation, drastically affecting high-growth and tech stocks that borrow at a higher rate to drive future growth.

Let the bears have their fun – it won’t last forever. For investors with a long-term horizon, it’s an absolute goldmine out there. Many of investors’ favorite stocks over the last several years have declined to levels we haven’t seen in some time, marking a rich buying opportunity.

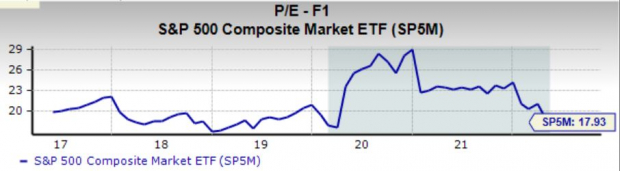

In fact, this five-year chart of the S&P 500’s forward earnings multiple shows us that the current value of 17.9X is well below 2020 highs of 28.6X and is sitting nicely below the median of 19.9X.

Image Source: Zacks Investment Research

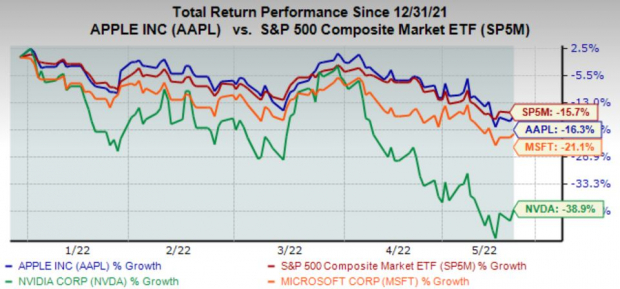

Three ultra-popular stocks – Microsoft

MSFT

, Apple (AAPL), and Nvidia

NVDA

– have all tumbled throughout 2022. The chart below illustrates how difficult an environment these companies have sailed through this year while blending in the S&P 500 for a benchmark.

Image Source: Zacks Investment Research

Amid all of the adverse price action, long-term investors have been presented with a juicy opportunity to add to their positions within all three of these stocks. Let’s look at just how stellar of an opportunity it is.

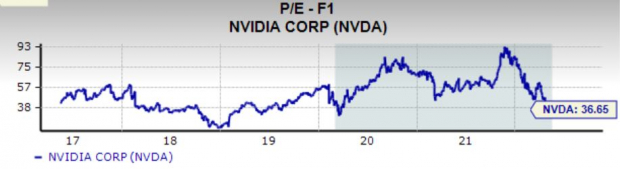

Nvidia

Nvidia

NVDA

, credited with being the inventor of the highly successful GPU, has seen its forward earnings multiple retrace back down to 36.7X, an absolute fraction of its 2021 high of 93.5X and well below the median of 49.9X over the last five years. Additionally, the value is the lowest we’ve seen since March 2020, providing an opportunity to scoop up shares at a much less expensive price point relative to how stretched valuations had become.

Image Source: Zacks Investment Research

After coming well off 2021 all-time highs of $334 per share, NVDA shares have been nearly cut in half, trading in the $180 range as of today. In fact, it’s the lowest level that we’ve seen Nvidia shares trade at since June 2021.

Image Source: Zacks Investment Research

The company has acquired a four-quarter trailing average EPS surprise of a respectable 7%, and in its latest report, the chip giant exceeded EPS estimates by 8.2%. Additionally, earnings growth rates are looking solid as well; NVDA’s current-year earnings are forecasted to grow 25% year-over-year, and the bottom line is forecasted to grow by a sizable 17% in the long term.

NVDA is a Zacks Rank #3 (Hold).

Apple

We’re all familiar with Apple

AAPL

, the creator of the legendary iPhone, Mac, and many other products. The tech-rout of 2022 has sent its forward earnings multiple down to 23.8X, nearly half of its 2020 high of 41.5X and just above its median of 19.5X over the last five years. Additionally, the value is sitting at its lowest level since April 2020.

Image Source: Zacks Investment Research

Sliding off of all-time highs of $182 per share back in early January of this year, AAPL shares are trading in the $140 range as of today, the cheapest we’ve seen since October of last year. Apple very rarely takes a step back in the market, marking another excellent buying opportunity for one of the best companies in the world.

Image Source: Zacks Investment Research

Over the last four quarters, Apple has acquired an average EPS surprise in the double-digits of 12%. In the face of adverse business conditions in its latest quarter, the company beat EPS estimates by a notable 6.3%. Additionally, earnings for the current year are expected to grow by 9%, and its bottom line is forecasted to grow by 13% over the next three to five years.

Apple is a Zacks Rank #3 (Hold).

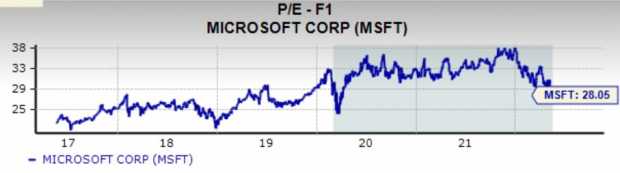

Microsoft

Microsoft

MSFT

, the widely-hailed tech giant, has seen its forward earnings multiple retrace down to 28X, a tick below its median of 28.1X over the last five years and a fraction of its 37.5X high in December of 2021. Similar to AAPL and NVDA, the value is the lowest since the early months of 2020.

Image Source: Zacks Investment Research

MSFT shares have come well off their all-time highs of $343 per share in December of 2021. As of today, shares are trading in the $260 range – the lowest level we’ve seen them trade at since late May of 2021.

Image Source: Zacks Investment Research

Over its last four quarters, the company carries an average EPS surprise of 9%, and in the latest quarter, MSFT beat EPS expectations by 2%. Looking ahead, current year earnings for the tech giant are forecasted to grow a sizable 17%, and over the next three to five years, the bottom line is forecasted to grow 13%.

Microsoft is a Zacks Rank #3 (Hold).

Bottom Line

As we can see, all three of these stocks have come down to valuation and price levels not seen in some time. Additionally, they’re all forecasted to have long-term EPS growth in the double digits, which bodes very well for them moving forward.

It’s far from over for these companies. While the market conditions have been brutal, to say the least, not all is bad – rich buying opportunities are continuously presenting themselves day in and day out.

Trying to time the bottom is hardly possible. Instead, investors should slowly build themselves into a position with periodically timed buys that allow flexibility to manage risk and build a strong average cost position. It’s never fun to go all-in on a purchase and watch the entry point become unfavorable.

The bears have had entirely too much fun. When reality sets in and these stocks bounce back, they will undoubtedly go back into hibernation.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report