Kimball Electronics Inc. (NASDAQ:KE) is among the small-cap companies that are generating sharp growths in financial numbers.

Kimball Electronics, an electronic manufacturing services provider of durable electronic products, has been serving several high growth markets. These markets include automotive, medical, industrial, and public safety. It has set sales records in the last nine successive quarters – which indicates that end markets are generating substantial demand for Kimball Electronics products.

Kimball Electronics Inc.: Record Third Quarter Results

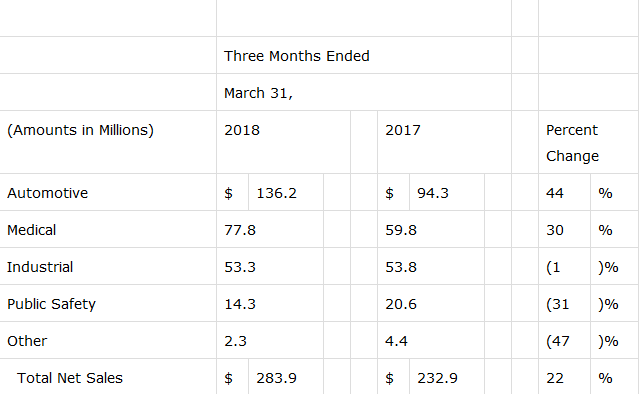

The company generated record sales of $284 million in the latest quarter – up close to 22% since last year. Its automotive and medical segments, the two largest business segments, reported year-over-year sales growths of 44% and 30%, respectively.

Kimball Electronics’ strategy of enhancing operational efficiencies and improving cost structure continues to strengthen the company’s margins. Its earnings per share rose 33% year-over-year in the latest quarter on a revenue growth of 22%.

>> RPO Market Move: Staffing 360 Acquires Clement May, Stock Closes Up 300%

Mr. Charron, the CEO of Kimball Electronics, believes they are well set to improve their profitability in the following quarters. He said, “The fourth quarter of the fiscal year 2018 is a pivotal quarter for our margin expansion efforts as we continue to focus on yield and throughput improvements on recently launched new programs and further progress on the ramp-up in Romania to help us achieve our goal of 4.5% operating income.”

Share Price Has Upside Potential

Kimball Electronics shares haven’t performed according to expectations. The stock is up only 11% in the last twelve months, whereas the company has generated double-digit growth in the previous nine quarters. Its shares are currently trading at around $20, down slightly from the 52-week high of $22 a share. Kimball Electronics shares are trading well below the industry average despite its strong growth in financial numbers. Its stock trades around 1.5 times to book value and 0.53 times to sales.

Featured Image: Twitter