- Uranium demand is expected to increase by 200% by 2040.

- Uranium prices are at 15-year highs due to tight supply.

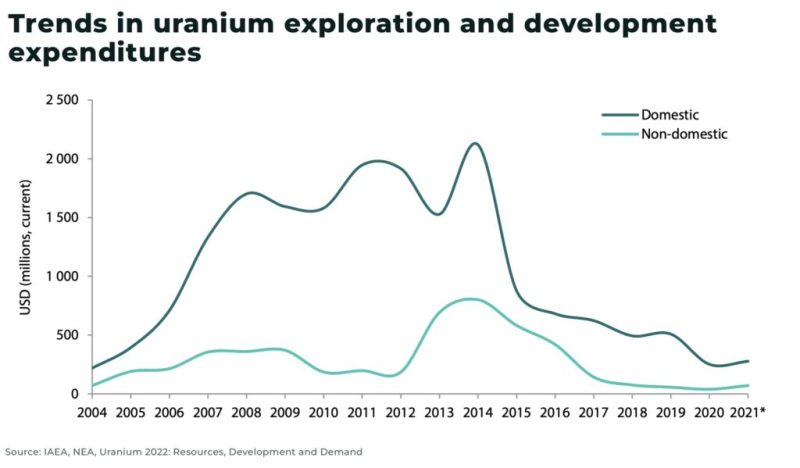

- Ore grade and mining bans globally are limiting new supply.

- Canada’s Thelon Basin is the world’s next high-grade uranium hotspot

A major clean energy investment trend is building momentum right now.

It isn’t related to EVs or solar power – but its rapid growth can no longer be overlooked.

Investors need to act soon to capture potentially substantial and long-lasting gains, which could remain strong throughout the decade.

The reason? Nuclear power is back in style.

In all my years in the markets, I’ve rarely seen a headline like this:

Source https://www.wsj.com/finance/commodities-futures/uranium-is-finally-running-hot-and-miners-cant-keep-up-e6a79367

Tight supply and rising demand have already pushed prices to 15-year highs, exceeding $80 per pound.

But this is just the beginning…

Major US banks all agree that uranium prices will continue to rise in 2024 and 2025. Bank of America expects prices to hit $105/lb this year 1 and $115/lb in 2025,2 while Citibank is forecasting a uranium price of $151/lb in 2025.3

In commodities, supply shortages, like those seen with lithium, present high-potential investment opportunities.

However, in the clean energy revolution, lithium plays a secondary role, while uranium takes the lead.

As of February 2024, at least 62 new reactors are under construction, with hundreds more planned or proposed.

Nuclear power is the only fully clean and sustainable way to generate massive amounts of electricity, making the dream of zero emissions a reality.

Demand for uranium is projected to rise by 28% by 2030 and nearly 200% by 2040.

What Will Power These Nuclear Power Plants?

Uranium is the lifeblood of nuclear reactors.

However, there’s already a severe uranium supply crisis, driving its price up 74% since last April.

With the insatiable demand from 21st-century industries, the deficit is likely to worsen.

The rise of massive data centers, bitcoin miners, and Gigafactories, all requiring huge amounts of energy, threatens US energy security.

Big tech giants like Microsoft’s Bill Gates and OpenAI’s Sam Altman are already investing big into nuclear energy.4

Amazon recently announced a staggering $150 billion investment in energy-hungry data centers and committed another $650 million to nuclear energy to ensure sufficient power.5

Microsoft signed a contract to purchase nuclear-generated electricity for its eastern US data centers.

Sam Altman sees nuclear energy as one of the best ways to solve the problem of growing demand for AI.6

At the same time, Goldman Sachs and hedge funds are racing to buy uranium and uranium producers.7

Adding to this intense demand are the needs of India, China, and emerging Asian economies, exacerbating the crisis.

This is fueling forecasts of significant uranium deficits—35 million pounds or more annually—expected to persist well into the next decade.

Uranium was one of the strongest-performing commodities in 2023, increasing almost 90% last year and quadrupling in price since 2020, but the global nuclear energy sector anticipates a threefold increase in capacity by the year 2050.

Historic Surge in Nuclear Power Projects: Global Capacity Set to Triple by 2050

New nuclear power project announcements are at historic highs:

-

- Over 20 countries across four continents have pledged to triple global nuclear capacity by 2050.8

- China plans at least 150 new reactors in the next 15 years, costing over $440 billion, more than the rest of the world has built in the past 35 years.9

- India aims to increase nuclear capacity from 6,780 MWe to 22,480 MWe by 2031, with nuclear energy accounting for nearly 9% of India’s electricity by 2047.10

- According to the International Atomic Energy Agency (IAEA), nuclear energy capacity could expand between 24% to 100% by 2050, depending on the scenario. Once these reactors are operational, they will use uranium continuously for 60–80 years.

Press Releases

- Generation Uranium Significantly Expands Its Flagship Yath Uranium Project In Nunavut, Canada

- Generation Uranium Engages APEX Geoscience Ltd. As Technical Consultants To Advance The Yath Uranium Project

- Generation Uranium Commences Trading On The Frankfurt Stock Exchange

- Generation Uranium Announces The Upsizing Of The Private Placement And The Closing Of $1,000,000 In First Tranche

- Generation Uranium To Begin Exploration Program On Its 100% Wholly Owned Yath Project In Nunavut, Canada

Global Uranium Supply Under Pressure: Thelon Basin Emerges as Key Player

Where can new uranium supply come online quickly enough to meet demand?

Right now, major producers are facing challenges and it’s creating concerns over future supply.

Kazakhstan:

- The largest producer of uranium globally, with 43% of supply and 12% of global reserves.11

- Production fell by 3% in 2022, and 2023 guidance was cut due to “wellhead development, procurement, and supply chain issues, including inflationary pressure.”12

- Kazakhstan and China have signed a long-term uranium supply deal.13

Australia:

- Despite the largest known uranium reserves, uranium mining is banned in much of the country.

- Western Australia has a ‘no uranium’ condition on future mining leases.

- New South Wales has had a 30-year ban on uranium mining.14

- Queensland revoked a ban in 2012, only to reinstate it in 2015.

- There is momentum to overturn some bans, but new mines could take 10-15 years to develop.

Africa:

Namibia, the world’s third-largest uranium exporter in 2022, is expected to grow production by 5% annually until 2026. However, the government may take a minority stake in mining projects, though the exact percentage is unclear.15

In Niger, the seventh-largest exporter, a recent coup has disrupted exports due to sanctions.16

Other mining opportunities face challenges like low reserves, geopolitical risks, and local opposition. For instance, Sweden plans to lift its uranium mining ban, but development will take years.

That leaves Canada.

Canada’s Thelon Basin:

Canada was the world’s leading producer of uranium until 2009, when Kazakhstan took the top spot by developing massive, low-grade deposits suitable for In Situ Leaching (ISL) extraction. Australia moved into second place in 2020.

However, in 2022, Canada reclaimed its position as the world’s second-largest uranium producer, with production increasing nearly 57%, from 4,693 tons in 2021 to 7,351 tons in 2022.17

The driving force behind this dramatic rise was the Athabasca Basin.

But now, Canada is turning its focus to the Thelon Basin, a region with immense potential for new uranium discoveries.

The Thelon Basin is quickly becoming a prominent player in the uranium market for several reasons:

- The Thelon Basin has extensive uranium showings, suggesting significant potential beneath its surface

- The Thelon Basin is larger than the Athabasca Basin and offers significant room for exploration and development

- Geologically similar to the Athabasca Basin, the Thelon Basin is gaining recognition for its high-grade uranium deposits

- Extensive uranium showings have been documented, indicating significant potential beneath its surface.

- In 2023 alone, over a million hectares were staked, highlighting the region’s potential

The Thelon Basin sits at the strategic center of Western critical mineral supply chains, offering a promising opportunity for investors as Canada seeks to expand its nuclear power fleet.

The excitement around the Thelon Basin is growing, with companies rapidly staking claims—over a million hectares were claimed in 2023 alone. This rush underscores the region’s immense potential for uranium deposits.

Strategic Developments in the Thelon Basin:

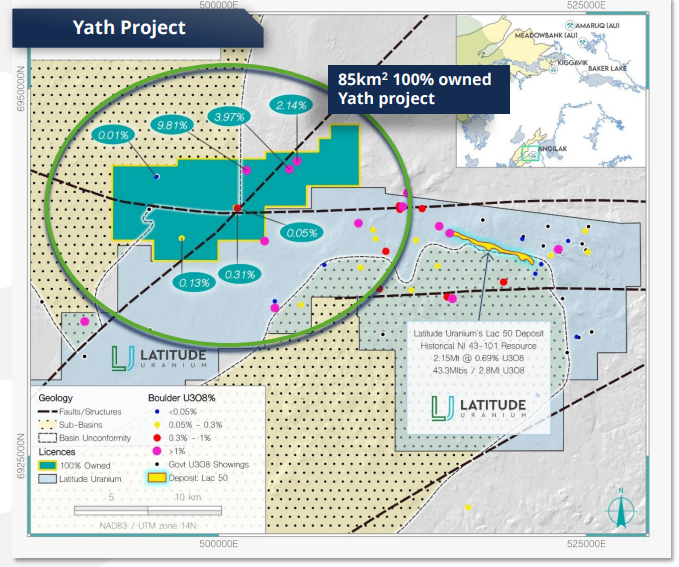

- Generation Uranium Inc.’s (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) Yath Project is strategically located near significant deposits, underscoring its potential. Historical exploration has consistently revealed stunning uranium concentrations between 1% and 10% U3O8, highlighting its significant promise.18

- ATHA Energy’s recent merger with Latitude Uranium emphasizes the strategic importance of the Thelon Basin.

- Greenridge Exploration‘s Nut Lake Project, located next to ATHA’s Lac 50 deposit, has shown promising results with high uranium grades.

How Can You Gain Exposure to the Nuclear Renaissance?

There are several ways investors can gain exposure to the uranium market including through ETFs, buy-and-hold options like the Sprott Physical Uranium Trust and Yellowcake, and current producers such as Kazatomprom, which offer existing cash flow opportunities.

For those focused on Canada, the Thelon Basin offers several compelling opportunities:

- High Discovery Potential: Significant untapped uranium resources, similar to the high-grade deposits in the Athabasca Basin.

- Large Exploration Area: Vast region with ample opportunities for new projects and discoveries.

- Growing Interest and Investment: Increased staking activity, with over a million hectares claimed in 2023, highlighting strong potential.

- Strategic Importance: Rising global demand for uranium boosts the value of the region’s resources.

- Stable Political Environment: Located in Canada, offering a supportive and low-risk investment climate.

- Advanced Technologies: Potential for efficient and cost-effective mining using modern methods.

- Partnership Opportunities: Increasing number of companies and investors present opportunities for strategic collaborations.

The Thelon Basin presents a unique opportunity to capitalize on the rising demand for uranium, and Generation Uranium Inc. (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) is well-positioned to become a key player in this burgeoning chapter of uranium exploration.

Departures Capital recently caught up with Generation Uranium Inc. (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) director Chris Huggins to discuss the company and its high-grade Yath Uranium Project.

Canada’s Uranium Growth Sees Generation Uranium Inc. Emerging as Essential Player

As a new player, Generation Uranium Inc. (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) injects fresh energy and substantial potential into the uranium market. The company’s tight share structure promotes focused and efficient growth, maximizing investor value.

Generation Uranium Inc. has shown impressive ability to secure significant capital for their projects, a critical factor as they advance their ambitious exploration and development initiatives.

With a targeted drilling strategy, Generation Uranium Inc. (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) aims to maximize discovery success by concentrating efforts on the most promising areas within the Yath Project, increasing the likelihood of significant finds.

The combination of strategic location, financial strength, and focused exploration makes Generation Uranium Inc. a prominent player in the emerging uranium frontier of the Thelon Basin, including the Yathkyed and Angikuni Basins.

Generation Uranium Inc. Shares the Same Trend as a Major New Deposit

Generally speaking, an explorer with good neighbors is usually a prime indicator that the company is onto something big.

That’s another reason we are so excited about Generation Uranium Inc. (TSXV:GEN) (OTCQB:GENRF) (FRA:W85).

Generation Uranium Inc.’s (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) Yath Project is strategically situated along the same trend as ATHA Energy’s Angilak Project, which hosts the Lac 50 Uranium Deposit – one of the largest high-grade deposits outside of the Athabasca Basin with a historical mineral resource estimate of 43.3M lbs at an average grade of 0.69% U3O8.19

Latitude Uranium recently completed an 18-hole diamond drill-based exploration program at Lac 50 in September 2023, which intersected grades of up to 7.54 % U3O8 over 1.6 meters.20

This proximity to a major deposit highlights Generation Uranium Inc.’s prime positioning within the Thelon Basin and emphasizes the immense potential of its 100% owned Yath Project.

Combine that with over $5 million of historical exploration at the project, and it’s clear that Generation Uranium Inc. (TSXV:GEN) (OTCQB:GENRF) (FRA:W85) has what it takes to make waves in the booming uranium market.